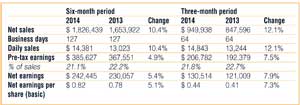

Net sales (and the related daily sales), pre-tax earnings, net earnings, and net earnings per share were as follows for the periods ended June 30:

Business update

In July 2013, Fastenal disclosed its intention to increase its investment in people at the store level and in additional leadership personnel at the district and regional levels. The company felt this expanded investment was necessary to add “selling energy” to the organization. With expanded investment, comes expanded expectations — in July 2013 Fastenal grew average daily sales over the same month in the preceding year in the low single digits, in June 2014 the company grew average daily sales over the same month in the preceding year by 12.7 percent.

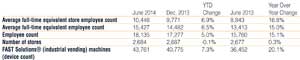

Fastenal believes these investments in “selling energy,” when combined with the related investments in “‘support energy” (people, distribution, and internal manufacturing capabilities), in new store locations, and in FAST Solutions® (industrial vending) devices gives it a great platform for growth. Set forth below is information related to average employee headcount during the quarters indicated, and actual employee headcount, store count and FAST Solutions® (industrial vending) device count as of the end of the periods indicated.

The opportunities provided by a large end market are self-evident; however the current challenges center on two things: gross profit and working capital. The company’s gross profit range is 51 to 53 percent. There are always competing priorities within any organization; for Fastenal, two of those priorities are sales growth and gross profit. Today, the dial is closer to sales growth and this is reflected in a lower gross profit percentage. Fastenal continues to believe in its stated range, but acknowledges the bottom half, and possibly just below the range, is a likely outcome for the short-term. Part of this acknowledgement relates to sources of the company’s growth, which is heavily related to large customer success given the advantage the company’s store-based business can bring to a multi-location customer.

The second challenge is working capital. Most of the challenge relates to sales mix. Large customers have the ability to leverage their scale into the payment terms they command. This slow change in the mix of payment terms within the company’s business has slowly extended the average number of days it has invested in accounts receivable. Fastenal has had similar short-term accounts receivable challenges in the past, and it has found ways to counteract the issue. This includes improving billing and collecting processes, improving the sales volume and the related inventory leverage, and improving sourcing.

Fastenal closed eight stores during the second quarter and identified additional stores it intends to close in the second half of 2014.