“Significant investments in EH&S software by oil and gas, mining and industrial manufacturing firms such as Syncrude Canada, Orica and Flexpipe Systems are driving a boom in the EH&S software market,” commented Jordan Nadian, Verdantix Analyst and author of the report. “Firms at different stages of maturity are getting in on the action. Those with existing EH&S software deployments at a site level are upgrading to more comprehensive systems to improve operational risk management and standardize processes. Laggards, who currently rely on Microsoft Excel and Sharepoint to achieve regulatory compliance, are investing in entry-level solutions, buying a few modules at a time to reduce their risk exposure.”

The Verdantix report, ‘EH&S Software Market Size & Forecast 2014-19’ is based on interviews with 250 heads of EH&S in 13 countries and deal flow data for 2013 sales from the 13 leading providers of EH&S software. Highlights from the study include:

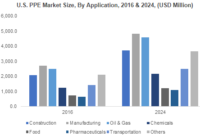

- Corporate investment in EH&S software for 2014 totals $584 million across eight of the world’s largest economies

- EH&S software spending will exceed $1 billion in 2018 in eight of the world’s largest economies, reflecting a 15 percent annual rate of increase

- Comparing industries, compound annual growth rates range from 6 percent in the mining sector to 17 percent in chemicals

- Oil and gas firms will account for 43 percent of total spend in 2019, representing $494 million of annual investment in EH&S software

“A combination of factors account for the hefty growth rates in the EH&S software market” commented Ross MacWhinney, Verdantix Senior Analyst. “All firms face risks from a failure to meet a complex and constantly changing regulatory landscape. That fact underpins market growth. On top of that, our research found that firms invest in EH&S software because they feel that without it they are falling behind industry best practice, they want to improve performance on metrics like injuries, fatalities and plant shut downs, and they need to provide consistent data for sustainability disclosures.”