In March of this year, OSHA released a report, Adding Inequality to Injury: The Cost of Failing to Protect Workers on the Job.1 The 20-page report focuses on how work-related injuries and illnesses force thousands of working families out of the middle class and prevents many low-wage earners from exiting poverty and realizing the American Dream.

The author(s) contend that even though an estimated three million injuries occur each year, “it is undoubtedly only a fraction of the true number.” Digging into the report’s Endnotes reveals a number of studies that have estimated injury numbers to be considerably higher than “officially” reported. For example, Dr. J. Paul Leigh estimated injury numbers as high as 8.5 million injuries in 20072 versus the Bureau of Labor Statistics 2007 number of total injuries at about 4 million.3

Considerable research exists on the underreporting of injuries and illnesses. In 2008, John W. Ruser provided a detailed accounting of the attention the Bureau of Labor Statistics was giving to the undercounting of injuries and illnesses, with particular emphasis directed at the BLS’s Safety and Occupational Injuries and Illnesses (SOII or Survey).4

A colossal waste

I would say there probably is some underreporting, although not to the degree these researchers claim. Frankly, I think the torturous path taken to precisely determine the number of injuries and illnesses that occur each year is a colossal waste of time. It’s a noisy distraction to the true issue at hand – what and how can we reduce the incidence and severity of injuries and illnesses.

According to the OSHA report, “the most effective solution to the problem… is to prevent workplace injuries and illnesses from occurring.”5 The primary accusation throughout: everything is the employer’s fault. The data just do not support such a ridiculous assertion.

The second area highlighted by the author(s) is the apparent broken workers’ compensation system, at least in their opinion. Workers’ compensation is a state-administered program, a form of “no-fault” insurance. Injured or ill employees do not have to fight an insurance company or file a lawsuit to prove company negligence. Employees are unable to recover anything more than partial wage reimbursement and medical/therapeutic expenses. Partial wage reimbursement can be reduced by as much as 25% if the employee failed to follow prescribed safety rules or wear proper PPE. An injured employee can receive workers’ compensation and Social Security Disability benefits, but only up to 80% of original earnings for which the workers’ compensation was based.

The author(s) claim the vast majority of employees eligible for workers’ compensation do not receive it for a variety of reasons (e.g., fear of termination for reporting an injury) and those that do can lose an average of 15% of earnings they would have expected to earn over a 10-year period following the injury.

Not a total disaster

The author(s) portray the entire workers’ compensation system as a disaster. Indeed, there are injured folks that probably did not receive fair compensation for their injury. These are case-by-case situations that warrant attention, but do not rise to the level of indicting the entire workers’ compensation system. There is one aspect, though, where premium payers need to ante up.

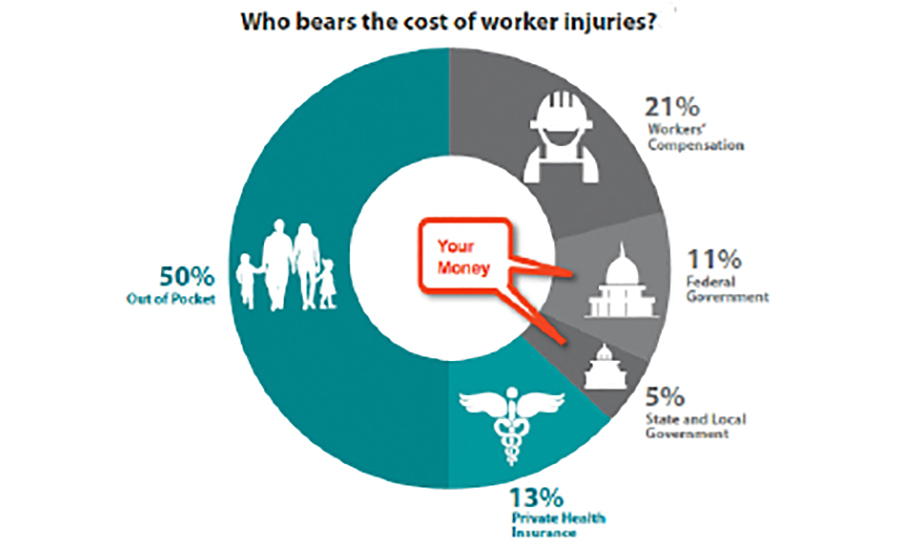

The most eye-opening illustration in the report is depicted above with my minor edits.

Assuming Leigh and Marcin’s illustration is correct, industry’s contribution to the cost of workers’ injuries through workers’ compensation is anemic, at best. Even worse is my tax dollars going to pay 16% of the total costs. Why should taxpayers or employees be saddled with the cost of injuries incurred at their workplace?

Unintended consequences

A number of unintended consequences will surface by requiring industry to pay premiums for workers’ compensation insurance based on current risk calculation methodology that covers “ALL” valid and verified workers’ injury expenses (medical/therapeutic/training/etc.) and full, not partial, wage requirements during and after injury to full recovery or through disability.

First, management, and possibly Wall Street, will begin viewing safety as a financial liability on their balance sheets, not unlike environmental liabilities, versus some nuisance costs.

Second, management will begin to devote the time, attention, and resources to ensure their safety management system is effective and delivering the performance it expects.

Third, the established safety management system will begin to set the company apart from its competitors and deliver competitive advantage.

Fourth, employees will recognize their role in the company is to work safely to avoid injury for the business, not to mention themselves, and enable their company to become more competitive.

In sum, the OSHA report tells us what we already know. Surely we can think of better ways to spend our tax dollars.

1 U.S. Department of Labor, OSHA. March 2015. Adding Inequality to Injury: The Cost of Failing to Protect Workers on the Job. At https://www.osha.gov/as/opa/quicktakes/qt031615.html

2 Leigh, J.P. Economic burden of occupational injury and illness in the United States. Milbank Quarterly 2011, 89: 728-772.

3 Bureau of Labor Statistics. News U.S. Department of Labor. Workplace Injuries and Illnesses 2007. Washington, D.C.

4 Ruser, J.W. August 2008. Examining evidence on whether BLS undercounts workplace injuries and illnesses. Monthly Labor Review. 131, 8: 20-32.

5 Op cit. pp. 2.

6 Leigh, J.P. and J.P. Marcin. 2012. Workers’ compensation benefits and shifting costs for occupational injury and illness. Journal of Occupational and Environmental Medicine. 54: 445-450.