The five game changers that could substantially boost GDP:

Four years after the official end of the Great Recession, U.S. economic growth remains lackluster. But there is more at work here than simply the business cycle: strains in the labor market were apparent long before 2008. Today, labor-force participation is at a 34-year low, and the United States has two million fewer jobs than it did when the recession began. Weak investment, demographic shifts, and a slowdown in productivity growth are dampening the economy’s trajectory.

But the United States does not have to resign itself to sluggish growth. Game changers: Five opportunities for U.S. growth and renewal, a new report from the McKinsey Global Institute (MGI), identifies specific catalysts that can add hundreds of billions of dollars to annual GDP and create millions of new jobs by 2020.

Driving growth and renewal in the U.S. economy

To identify these catalysts, MGI looked for developments that are poised to achieve scale immediately and could accelerate growth across multiple sectors by 2020. We also focused on areas with an immediate window for action.

Game changers zeroes in on five mutually reinforcing opportunities:

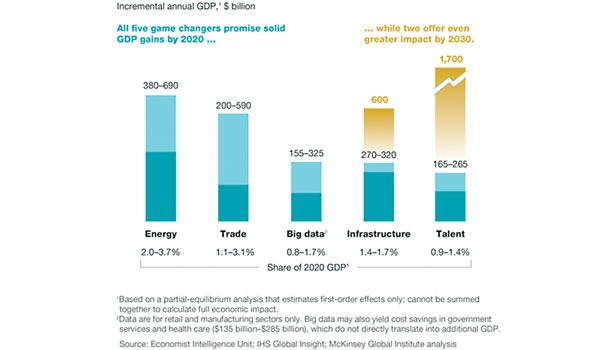

- Shale-gas and -oil production. Powered by advances in horizontal drilling and hydraulic fracturing, the production of domestic shale gas and oil has grown more than 50 percent annually since 2007. The shale boom could add as much as $690 billion a year to GDP and create up to 1.7 million jobs across the economy by 2020. The impact will extend to energy-intensive manufacturing industries and beyond. The United States now has the potential to reduce net energy imports to zero—but only if it can successfully address the associated environmental risks.

- U.S. trade competitiveness in knowledge-intensive goods. The United States is one of the few advanced economies running a trade deficit in knowledge-intensive industries. But changing factor costs, a rebound in demand, and currency shifts are creating an opening to increase U.S. production and exports of knowledge-intensive goods, such as automobiles, commercial airliners, medical devices, and petrochemicals. By implementing five strategies to boost competitiveness in these sectors, we believe the United States could reduce the trade deficit in knowledge-intensive industries to its 2000 level or close it— which would add up to $590 billion in annual GDP by 2020 and create up to 1.8 million new jobs.

- Big-data analytics as a productivity tool. Sectors across the economy can harness the deluge of data generated by transactions, medical and legal records, videos, and social technologies—not to mention the sensors, cameras, bar codes, and transmitters embedded in the world around us. Advances in computing and analytics can transform this sea of data into insights that create operational efficiencies. By 2020, the wider adoption of big-data analytics could increase annual GDP in retailing and manufacturing by up to $325 billion and save as much as $285 billion in the cost of health care and government services.

- Increased investment in infrastructure, with a new emphasis on productivity. The backlog of maintenance and upgrades for U.S. roads, highways, bridges, and transit and water systems is reaching critical levels. The U.S. must increase its annual infrastructure investment by one percentage point of GDP to erase this competitive disadvantage. By 2020, that could create up to 1.8 million jobs and boost annual GDP by up to $320 billion. The impact could grow to $600 billion annually by 2030 if the selection, delivery, and operation of infrastructure investments improve.

- A more effective U.S. system of talent development. The nation’s long-standing advantage in education and skills has been eroding, but today real improvements are within reach. At the postsecondary level, expanding industry-specific training and increasing the number of graduates in the fields of science, technology, engineering, and math could build a more competitive workforce. At the K–12 level, enhancing classroom instruction, turning around underperforming high schools, and introducing digital learning tools can boost student achievement. These initiatives could raise GDP by as much as $265 billion by 2020—and achieve a dramatic “liftoff” effect by 2030, adding as much as $1.7 trillion to annual GDP.

These opportunities can have immediate demand-stimulus effects that would get the economy moving again in the short term and also have longer-term effects that would build U.S. competitiveness and productivity well beyond 2020. Taking action now could mark a turning point for the U.S. economy and drive growth and prosperity for decades to come.

Looking back

Five years after the start of the global financial crisis, the longest downturn in U.S. postwar history has given way to a lackluster recovery. Deleveraging, a fragile housing market, restructuring in the financial system, and fiscal austerity have posed formidable headwinds to U.S. growth. In late 2012, however, the Congressional Budget Office issued a report revising potential GDP downward for reasons that have received far less attention: weak investment in the underlying productive capacity of the economy, demographic shifts, and a slowdown in productivity growth.

There is more at work here than simply the business cycle, and this decline in future potential should be a call to action. Structural problems have been brewing in the U.S. economy for decades. Today the national unemployment rate has ticked down to 7.6 percent, but improvement in this number masks the fact that labor force participation has dropped from 67.3 percent in 2000 to 63.4 percent in May 2013, touching a 34-year low. Despite the recovery, the U.S. economy still has two million fewer jobs than when the recession began.

If young Americans are to enjoy the same increase in living standards over their lifetime as previous generations, the United States must expand employment, make its workforce more competitive, and sharply accelerate productivity growth that is driven by innovation and higher-value goods and services. The latter will be a challenge, not least because a large share of the economy is now composed of sectors with historically stagnant or below-average productivity growth, including health care, government, education, and construction.

But the United States does not have to resign itself to sluggish growth. This report identifies game changers in energy, trade, big data, infrastructure, and talent. Within each of these areas, we explore the most promising opportunities for growth, including the continued expansion of shale gas and oil production; increased U.S. trade competitiveness in knowledge-intensive goods; the potential of big data analytics to raise productivity within sectors; increased investment in infrastructure, with a new emphasis on its productivity; and new approaches to both K–12 and post-secondary education.

What constitutes a game changer?

Over the past five years, the McKinsey Global Institute has studied the performance of the U.S. economy from multiple angles, including the jobless recovery and labor market mismatches, large multinational companies and eroding competitiveness, the productivity challenge, savings and the demographic transition, and deleveraging from the financial crisis.

These five game changers were chosen from a longer list of ideas we considered, and they are drawn from broad categories that are foundational to the U.S. economy. They are possible today because of technology breakthroughs; changing costs of capital, labor, and energy around the world; policy innovation at the state and local levels; or new evidence-based understanding of how to address long-standing problems.

Some may disrupt entire industries—and all have the potential to impact multiple sectors. Moreover, the five game changers presented here are mutually reinforcing. The shale boom, for example, is boosting trade competitiveness, particularly in energy-intensive manufacturing, as the shift in input costs caused by cheap natural gas has made the United States a more attractive place to base production. Big data can play a role in raising the productivity of knowledge-intensive manufacturing for export, maximizing infrastructure assets, and facilitating new personalized digital learning tools. Shoring up U.S. infrastructure is necessary to capture the potential of the shale energy boom and facilitate greater trade. A talent revolution is needed to train tomorrow’s energy engineers and big data analysts, as well as the skilled workforce needed for a 21st-century knowledge economy.

These opportunities can exert two types of economic impact: more immediate demand stimulus effects that can get the economy moving again in the short term, and longer-term enabling effects that build competitiveness and productivity well beyond 2020.

The shale boom, for example, has already provided an immediate spark as it coaxes private capital off the sidelines and leads to new investment in both oil and gas production and energy-intensive manufacturing.

Increased trade competitiveness can have a relatively rapid impact by leveraging global demand and building on U.S. strengths in innovation.

Big data, by contrast, is already being adopted by a range of U.S. companies, but it will take time to reach critical mass and raise sector-wide productivity.

Infrastructure investment can be a powerful short-term stimulus and boost to employment, but as with talent development, it also has important long-term enabling effects on the rest of the economy. The impact of these two game changers would grow in magnitude from 2020 to 2030 as the U.S. stock of human capital and infrastructure deepens.

So why these five game changers?

Many ideas have been offered for reviving economic growth. Startups, renewable energy, and the “reshoring” of manufacturing are commonly offered as solutions that can accelerate the current weak recovery.

In this research, we attempt to sort through the possibilities to identify the opportunities with the greatest potential for economic impact. While acknowledging that some options not discussed in this report also hold promise, we believe that we have identified a set of five priorities that could spur growth and renewal in the U.S. economy by 2020.

To narrow down the possibilities, we set the following parameters:

- Each development had to be a catalyst with the ability to drive substantial growth in GDP, productivity, or jobs.

- It had to be poised to achieve scale now and capable of producing tangible impact by 2020.

- And it had to have the potential to accelerate growth across multiple sectors of the economy.

Some topics were combined into one larger category. For example, K–12 education reform, workforce skills, and immigration were consolidated into one game changer on talent development.

The link between innovation and economic growth is widely accepted, but proxy metrics that are typically used to measure innovation—R&D spending, patents, number of scientists and engineers—provide only a partial picture of innovative activity.

Finally, we excluded other topics because they address mainly cyclical challenges rather than long-term opportunities. Reviving business startups is an example. The rate of new business creation collapsed in the Great Recession, falling nearly 25 percent from 2007 to 2010 and erasing the potential for 1.8 million jobs that would otherwise have existed today. Reviving the startup engine is an important priority, as new businesses that are less than one year old generate nearly all net new jobs.

However, a longer historical perspective shows that, apart from the past few years, startup creation in the United States has remained remarkably stable as a share of the civilian labor force since 1990.

Furthermore, a gradual recovery in the number of startups is already underway. Although their recovery is not complete, it appears that business creation is primarily a cyclical rather than a chronic issue.

We also considered possibilities for raising the productivity and performance of specific large sectors of the economy—health care, the public sector, and manufacturing, in particular. Although transforming these sectors could have a major impact, we chose instead to focus on opportunities that can benefit multiple sectors and lay a new foundation for growth.

Among the other ideas considered were foreign investment, reshoring, advanced robotics, advanced materials, 3D printing, broadband, genomics, nanotechnology, renewables, and resource efficiency. Created by 3M, the vitality index has been adopted by many other companies to measure new product revenue as a percentage of total revenue. Measuring this economy-wide and over time would be challenging due to data limitations.

There are many different views on the state of U.S. entrepreneurship. The Kauffman Index of Entrepreneurial Activity shows that business creation actually increased during the recession.

Each of the five game changers has the potential to boost annual GDP by at least $150 billion by 2020. In most cases, the potential is much greater—almost $700 billion by 2020 for shale energy, and up to $1.7 trillion by 2030 for talent. The impact on employment is also striking, with three of the game changers (energy, infrastructure, and trade) potentially creating more than 1.5 million new jobs each.

More subtly, concerted action to realize these opportunities can build general confidence that encourages investors, companies, and would-be entrepreneurs to focus their energies on the United States, creating a positive cycle. In addition, the game changers will have far-ranging economic, social, and policy implications. Although the benefits of pursuing these goals simultaneously would vary across different parts of the U.S. economy, the resulting complementary effects would enhance the nation’s overall competitiveness, productivity, innovation, and quality of life.

The projections associated with each game changer are based on quantitative analysis as well as the insights of multiple industry and policy experts. While it is tempting to add these numbers together into a rosy forecast for trillions of dollars in additional GDP, we caution that these scenarios are not meant for simple addition. Each one was calculated in isolation and did not consider the second-order effects on prices and exchange rates. Our calculations are also not predictions of how much of the opportunity will actually be realized. They are meant to demonstrate the size of the potential impact and explore the actions needed by both business leaders and policy makers to pursue these game changers.

Each one is a partial-equilibrium comparative static analysis that estimates only the first-order magnitude of impact. These calculations do not take into account second-order effects such as those due to changes in the value of the U.S. dollar, interest rates, or inflation.

This article was originally published in McKinsey & Company, www.mckinsey.com. Copyright (c) 2013 McKinsey & Company. All rights reserved. Reprinted by permission. www.mckinsey.com/insights/americas/is_game_changers.